Buckle up, because the Fed is about to hit the nitro and send your portfolio soaring to new heights. That’s right, the latest inflation reports are in, and they spell nothing but HUGE upside for smart investors positioned to profit.

As our good friend Louis Navellier reports, Fed Chair Jerome Powell is practically giddy over the “modest further progress” we’re seeing on inflation. In his own words, “more good data would strengthen our confidence that inflation is moving sustainably toward 2%.” Music to my ears!

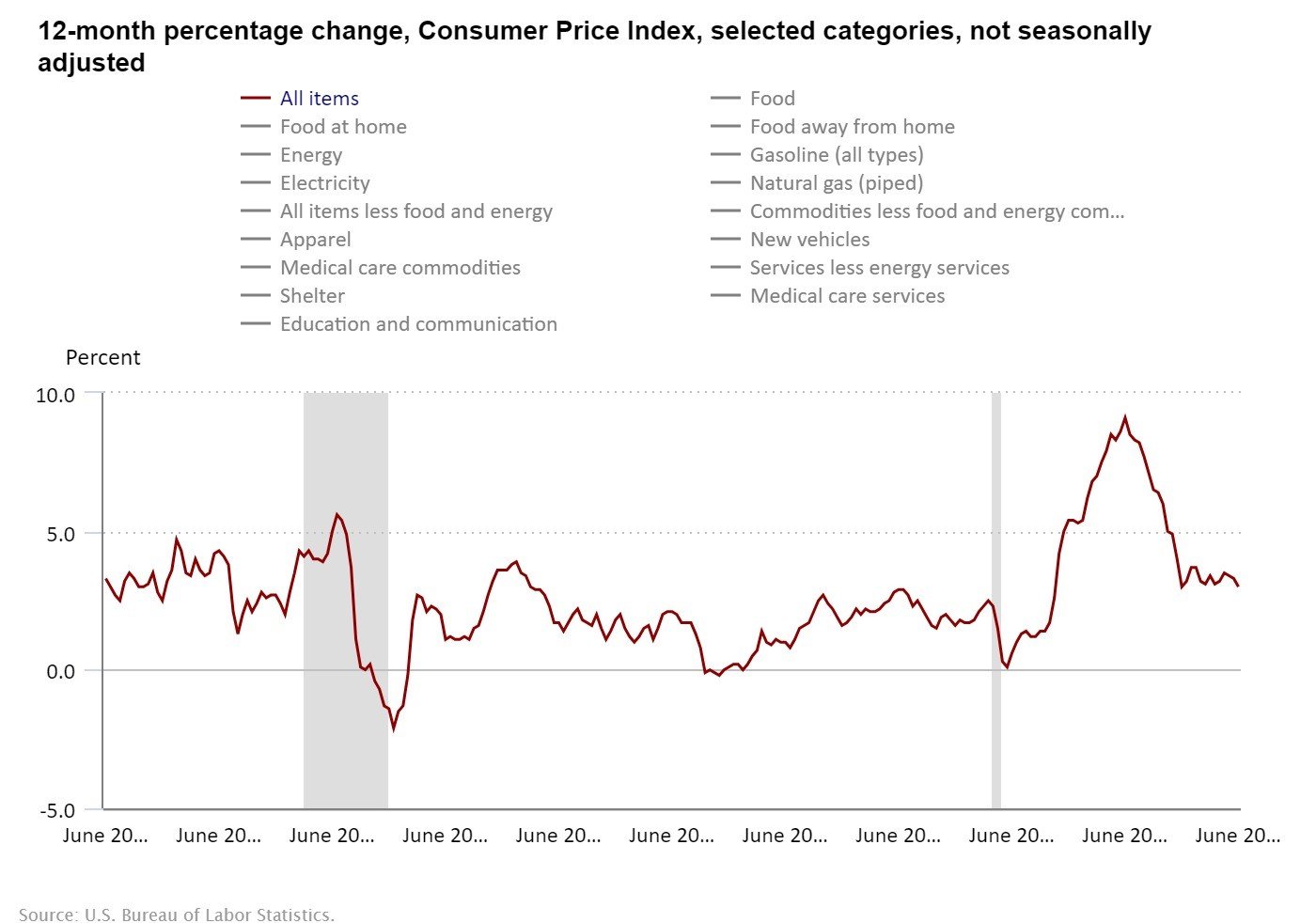

The CPI posted its first monthly decline since May 2020 – a stunning result that has Powell smiling from ear to ear. Source: InvestorPlace

Louis hits the nail on the head, saying:

“The fact is, as market rates come down, it puts pressure on the Fed to cut rates…The current market rates will lead the Fed lower, and they will have to cut key rates sooner rather than later.”

Louis Navellier

Forget waiting until September – if I was running the show, I’d be slashing rates at the July meeting. But even with the Fed dragging their feet, the writing is on the wall. Rate cuts are coming, and they’re going to light a fire under this market rally.

So how do you cash in on the coming boom? It’s simple: stuff your portfolio with the fundamentally superior growth stocks that are poised to post explosive earnings. We’re talking companies forecasting 120%+ profit growth on average.

That’s the kind of rocket fuel that can propel your wealth to incredible new heights. And you’ll find them ready to buy on Louis Navellier’s Growth Investor Buy Lists. His top picks are already trouncing the market, with his High-Growth Investments up 23% in the first half while the S&P 500 managed just 14.5%.

Don’t miss this opportunity to turbo boost your returns. Click here now to get Louis’ latest recommendations and position yourself for the Fed-fueled profit frenzy ahead.

The rate cuts are coming. Make sure you’re in the driver’s seat and ready to capitalize.