If you’ve been worried sick about the economy lately, you’re not alone. But according to my good friend Chris Igou over at Daily Wealth, it’s time to take a deep breath and keep your eyes on the prize.

Chris hits the nail on the head in his latest article, “The Economy Is Falling Short of Expectations“. He points out that while everyday Americans have been feeling the pain of inflation and uncertainty, the hard economic data has actually been pretty darn solid – until recently.

As Chris explains, “Economic data has been worse than expected in recent weeks. But don’t give up hope… As I’ll explain, this isn’t the death blow to the markets that you might expect.”

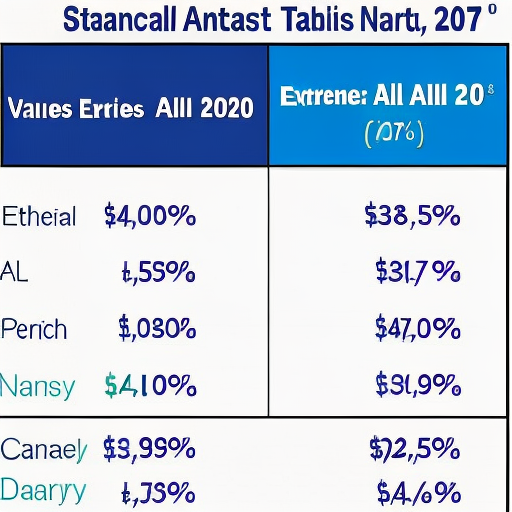

He’s absolutely right. Just take a look at this chart from the article:

History shows that when the economy starts disappointing analysts like it is now, it’s actually a massive contrarian buying signal. Similar setups have led to stock gains of 9.7% over the next year, almost double the typical annual return since 2000!

As Chris sums it up perfectly, “Everyday Americans saw the cracks in today’s economy long before they showed up in the data. Now, the numbers have confirmed more of those worries… But that won’t kill this bull market.”

So here’s my urgent message to you: don’t let the economic naysayers scare you out of this market. The upside potential is simply too great to ignore. As the legendary Porter Stansberry recently put it, you “can’t afford to be out of the market” right now.

Of course, you still need to be smart about how you invest. That’s why I highly recommend checking out this video where Porter shares a strategy to help protect your gains no matter what happens next.

The bottom line is this: fortunes are made by zigging when everyone else is zagging. While the crowd is cowering in fear over some disappointing data, you need the conviction to stay in the game and positioned for profits.

So keep your head on a swivel, but don’t take your chips off the table. The bulls are still running on Wall Street – make sure you’re running with them.

Saddle up and stay invested,

The Market Monitor