Advanced Micro Devices, Inc. (AMD) has been lighting up the stock market lately, and if you’re not paying attention, you could miss out on a golden opportunity. With its meteoric rise, AMD is grabbing the spotlight and showing every sign of becoming your next essential portfolio pick. Let’s dive into why this tech giant is the one to watch right now.

AMD’s Phenomenal Performance Backed by Market Trends

AMD’s stock price has seen a notable surge, jumping by 6.86 points—a robust 3.87% increase—bringing the current trading price to a solid $183.96. But it’s not just the price hike that’s catching attention; it’s the incredible trading volume. Recently, 90 million shares changed hands, indicating a high level of interest and liquidity in AMD stocks.

This surge aligns perfectly with broader market trends. The Dow has been narrowing its losses, and the 10-year Treasury yield has decreased by 5 basis points to 3.99%. These economic conditions are setting the stage for stocks like AMD to flourish. With the PC-chip industry showing upbeat trends and more realistic expectations for AI revenue growth, AMD is riding a wave that shows no sign of cresting.

Analyst Insights: Positive Earnings and Technological Edge

AMD’s recent performance goes beyond market momentum—its financials are glowing. In the March quarter, the company reported adjusted earnings of 62 cents per share on sales of $5.47 billion, blowing past analysts’ expectations. Such results underscore AMD’s robust financial health and strategic deftness, reassuring investors of its resilient growth trajectory.

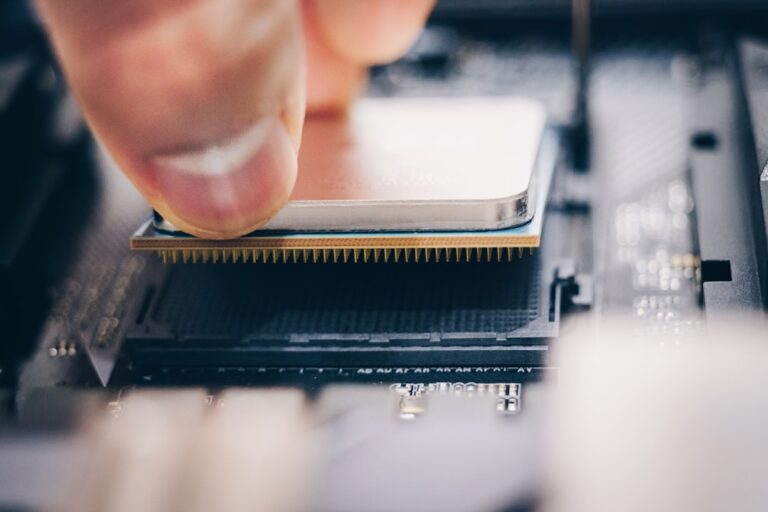

The technological advancements underpinning these gains can’t be overlooked. AMD has rolled out significant innovations in its chip technology, escalating its competitive edge over major players like Nvidia. This tech prowess isn’t just about keeping pace; it’s about leading the race in the global chip market.

Future Prospects: Ready for Continued Growth

What’s more exciting is the road ahead for AMD. Analysts are bullish, foreseeing continued growth driven by sustained industry trends and AMD’s relentless technological advancements. The stock has been earmarked with a profit-taking zone at 20%-25%—an insightful metric for anyone pondering an entry point. The identified buy point at $122.11 cup-with-handle further underscores the investment potential.

Here’s a snapshot of key metrics for quick reference:

| Metric | Value |

|---|---|

| 6.86 points increase | 3.87% increase |

| Profit taking zone | 20%-25% |

| Buy point | 122.11 cup-with-handle |

| Total shares exchanged | 90 million |

These data points are more than just numbers—they spotlight AMD’s robust performance and promising future.

As AMD continues to lead with innovative technology and solid financial results, it’s clear that this isn’t just a fleeting moment but a compelling story in the making. Keep your radar tuned in; AMD might just be the next big win for your investment portfolio. Stay sharp, stay informed, and don’t let this opportunity slip by.